In 2025, IQ went full DeFAI. We launched the Agent Tokenization Platform (ATP), transforming AI agents into economic actors, and brought the Korean won onchain with KRWQ. And the IQ token is at the center of it all.

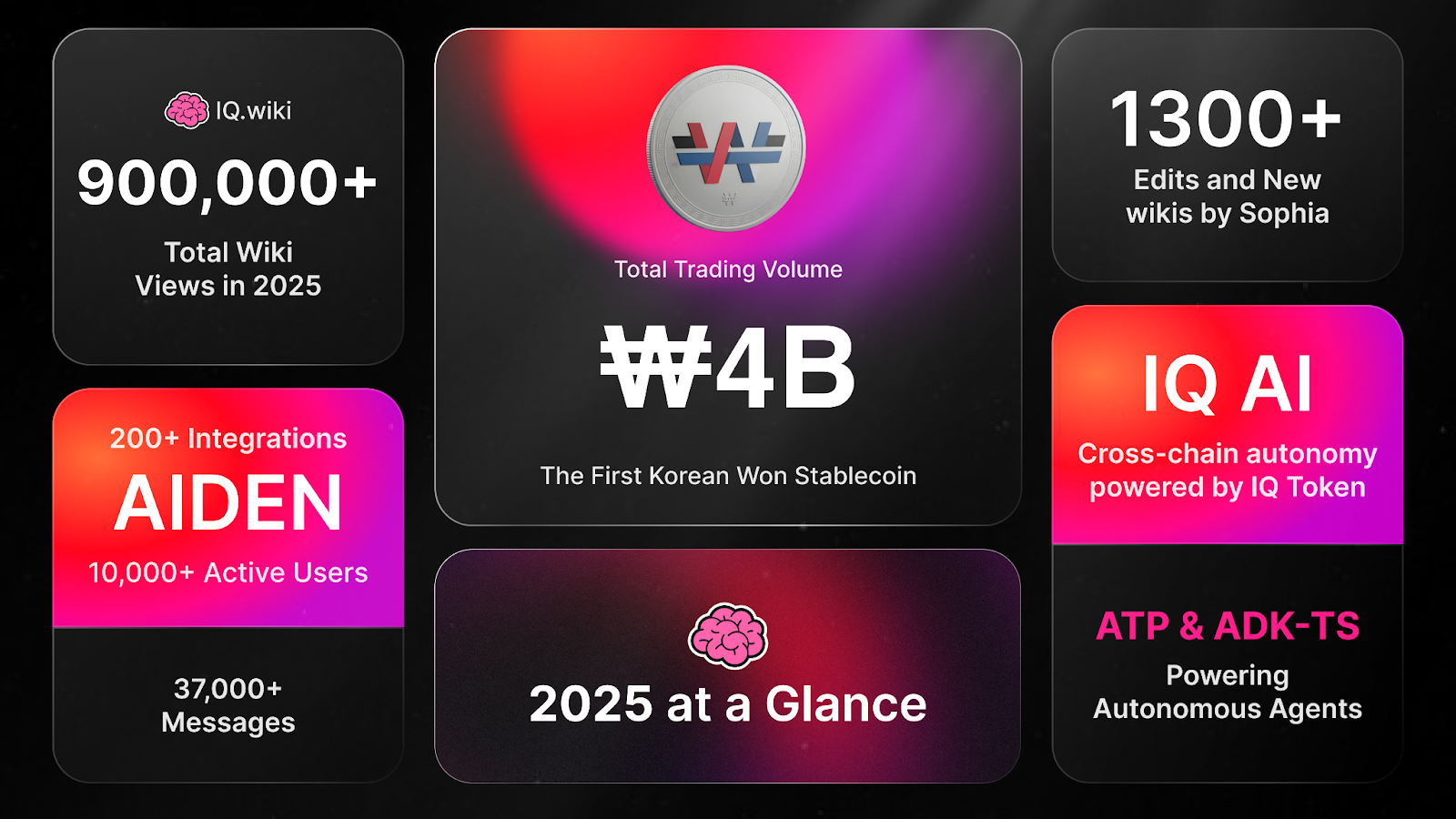

2025 at a Glance

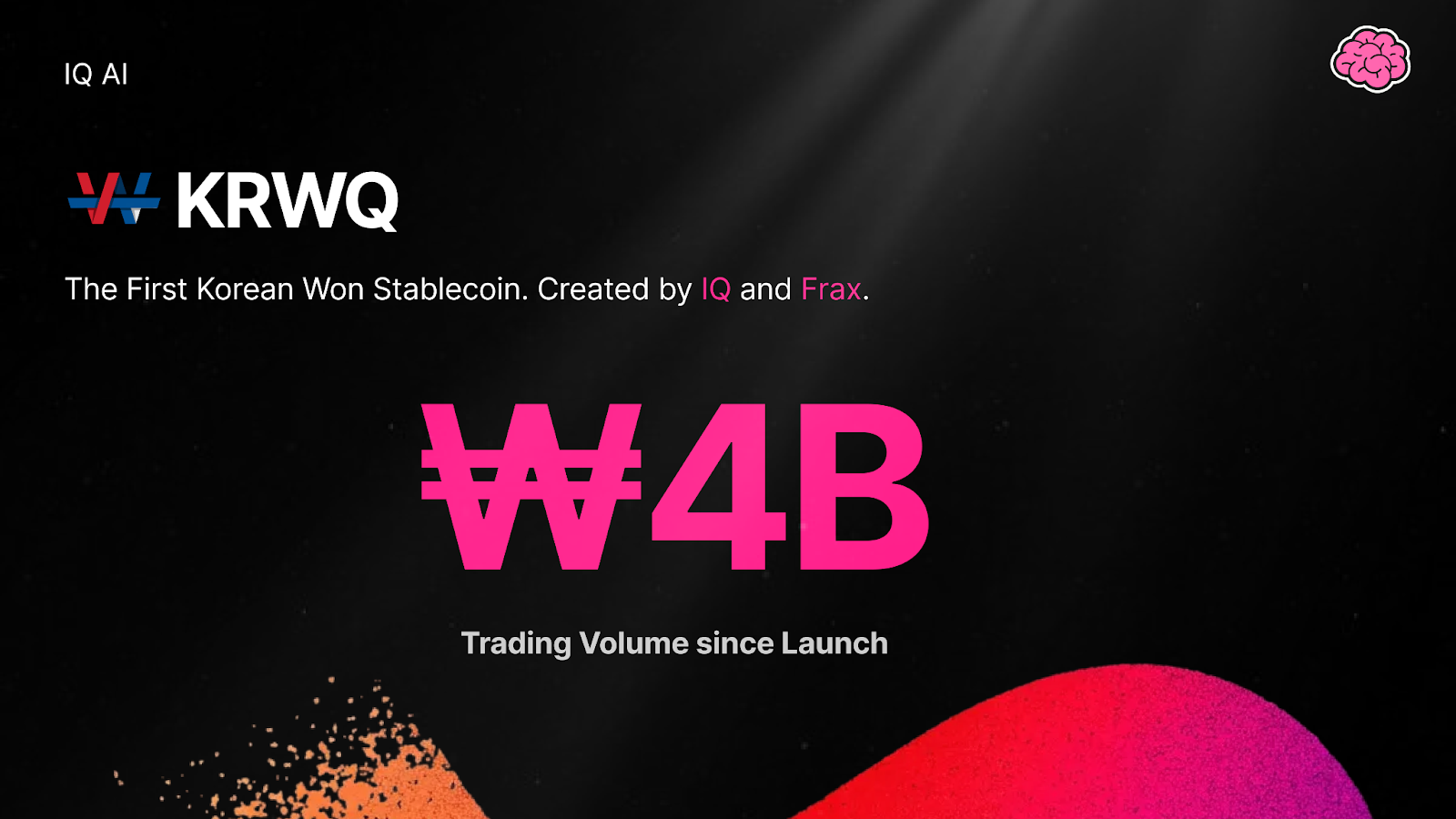

KRWQ

- First Korean won stablecoin

- ₩4 billion in total trading volume

- Live on Base and Ethereum

IQ AI

- Agent Tokenization Platform + ADK-TS Launch

- Cross-chain autonomy powered by NEAR Intents

IQ.wiki

- 900,000+ total wiki views in 2025

- 1,300+ new wikis created by Sophia

- 1,300+ edits made by Sophia

AIDEN

- 200+ integrations

- 37,000+ messages

- 10,000+ active users

Moments That Defined the Year

- KRWQ Launch

In October, IQ and Frax launched KRWQ, the first Korean won stablecoin. Since launch, KRWQ has passed ₩4 billion in total trading volume. With the KRWQ-USDC pair live on Aerodrome, KRWQ became the first KRW stablecoin to enter production on Base, Coinbase’s Ethereum Layer 2, and the first to launch using LayerZero’s Omnichain Fungible Token (OFT) standard and Stargate bridge. From day one, KRWQ was designed for unified liquidity and seamless cross-chain movement, allowing the won to exist natively across multiple blockchain ecosystems.

The launch combined IQ’s long-standing footprint in the Korean market, dating back to its 2018 launch in Seoul and early liquidity on Upbit and Bithumb, with Frax’s institutional-grade stablecoin infrastructure. Built on the same principles that underpin frxUSD, including transparent reserves and a compliance-first design aligned with the U.S. GENIUS Act framework, KRWQ was structured for exchanges, market makers, and institutional counterparties rather than retail distribution. Decentralized liquidity pools began immediately with a KRWQ-USDC pair on Aerodrome, with BrainDAO committing treasury resources to deepen liquidity as adoption grew. KRWQ also became the first KRW stablecoin available for trading through the OKX app with OKX DEX, extending its reach into global exchange infrastructure.

Recently, KRWQ underwent a major infrastructure expansion into FraxNet. As part of the integration, KRWQ became available on the Ethereum mainnet in addition to Base and integrated with key Frax infrastructure, including FraxNet routing and new KRWQ-frxUSD liquidity pools on Uniswap v4. KRWQ also joined the Circle Alliance Program, a global community of teams working to bring the world onchain using USDC. As a member, KRWQ is positioned to collaborate with leading protocols and institutions building on USDC, further strengthening its role as a compliant KRW gateway into the broader stablecoin economy and reinforcing the KRWQ-USDC corridor as a core onchain market. In December, KRWQ was mentioned in Messari's 2026 Crypto Theses report as the first multichain Korean won stablecoin deploying cross-chain using LayerZero's OFT.

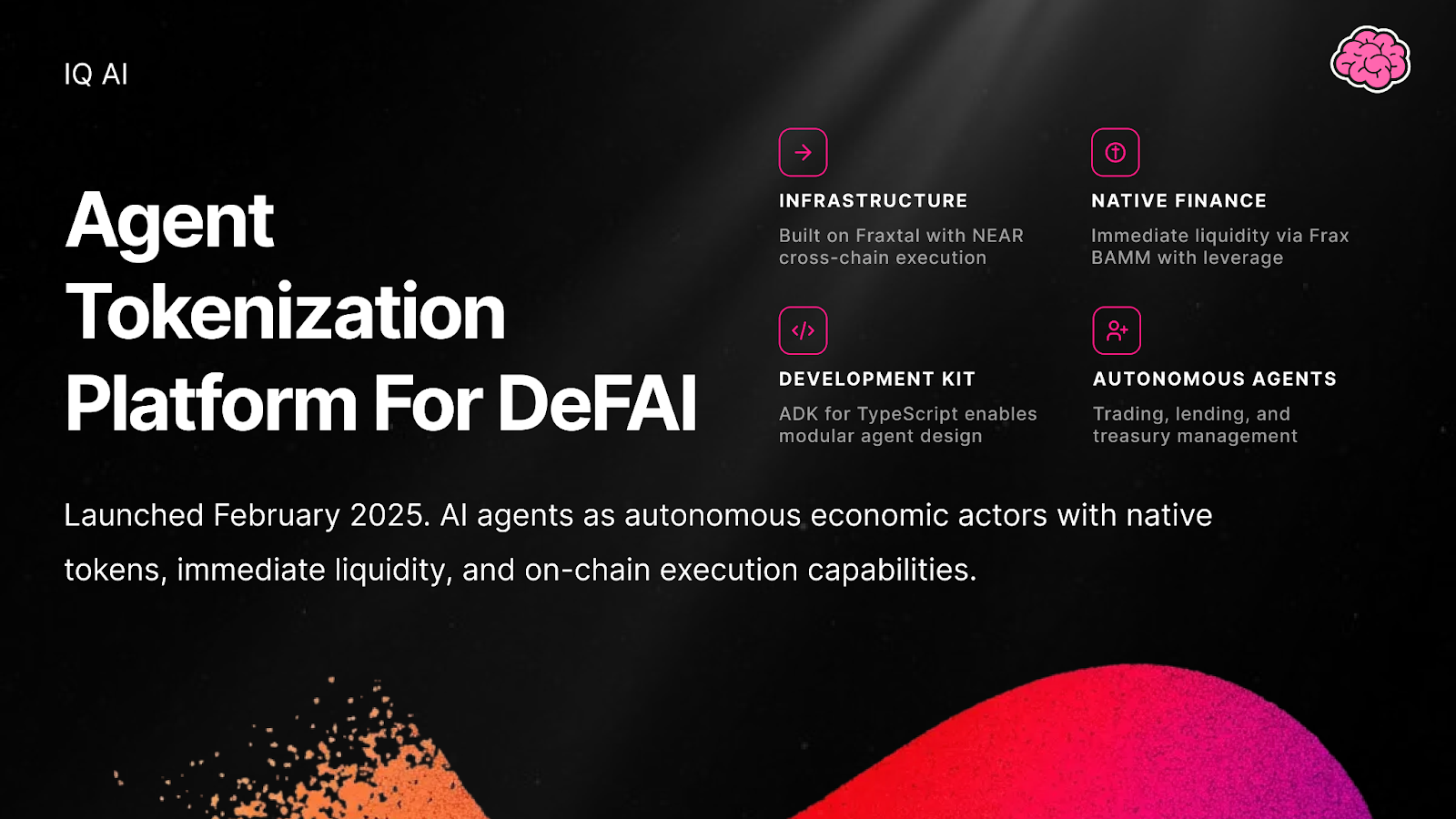

- ATP Launch

In February 2025, IQ AI launched the Agent Tokenization Platform (ATP), designed specifically for DeFAI, the intersection of decentralized finance and autonomous AI agents. Built on Fraxtal and deeply integrated with NEAR infrastructure, ATP enables AI agents to own assets, execute onchain actions, and participate in financial markets without human intervention. Each agent launched on ATP has its own token, its own liquidity, and direct economic relationships with the broader IQ ecosystem, with all fees settled in IQ.

What made ATP structurally different from previous AI agent platforms was its native financial stack. Agents launch with immediate liquidity and lending markets via Frax’s Borrow Automated Market Maker (BAMM), enabling leverage, yield strategies, and capital efficiency from day one. ATP also integrates cross-chain execution through NEAR Intents and supports modular agent design via the Agent Development Kit (ADK) for TypeScript, allowing developers to compose reasoning, memory, and onchain actions into autonomous systems. In practice, this meant agents were not just interfaces or bots, but economic actors capable of trading, lending, arbitrage, and treasury management. The launch of ATP set the foundation for the year that followed, bringing SOPHIA, AIDEN, and a growing roster of agents onchain, and established a clear model for how AI agents, tokens, and DeFi infrastructure can operate as a single, integrated system.

- ADK-TS Launch

In July 2025, ADK-TS launched as the TypeScript-native Agent Development Kit for IQ’s agent economy. Over the year, it expanded with major capabilities. Cross-chain execution arrived through NEAR Intents, onchain, pay-per-call agent monetization became possible through x402 payments, Model Context Protocol servers unlocked standardized external tooling, while NEAR Shade Agents introduced secure autonomous execution using trusted hardware environments and chain signatures. At the same time, ADK-TS matured with built-in memory, streaming responses, observability, and multi-agent coordination.

Then the builders arrived. The first global ADK-TS hackathon brought together 122 developers from around the world, introducing 50 projects, with 34 teams reaching the final stage. Agents, MCP servers, and Web3 integrations shipped in just weeks, proving that the toolkit was immediately usable. That momentum carried directly into the physical world with Agent Arena in Seoul, IQ AI’s first offline AI agent hackathon. Designed for university students and backed by Frax and KRWQ, the month-long event featured a $7,000+ prize pool and created a real-world pipeline of Korean AI builders entering the onchain agent economy.

The winning projects from the Agent Arena Hackathon highlighted the growing adoption of tokenized, onchain AI agents built with IQAI’s ADK-TS framework. Rogue, the first-place winner, launched on the Agent Tokenization Platform (ATP) with its native $RGE agent token. Rogue operates as an autonomous crypto trading oracle, scanning global markets and executing trades on Hyperliquid through coordination between more than 10 specialized agents drawing on over 30 data sources. Athena, awarded second place, is an agent designed to help women in dangerous situations achieve independence and escape safely. Built on Fraxtal L2, Athenea combines custodial blockchain wallets, immutable IPFS evidence storage, and an empathetic AI companion powered by Google Gemini 2.5 Flash. CryptoInsight AI, which placed third, is a crypto analysis platform providing insights through five specialized agents covering market analysis, portfolio tracking, Web3 execution, chart analysis, and natural-language interaction. The IQ AI MVP, ResearchOS, is an autonomous research copilot, using multi-agent orchestration to search, analyze, and synthesize academic literature, and automating literature reviews into workflows through specialized planning, search, synthesis, report-writing, and RAG-powered Q&A agents.

- SOPHIA Tokenizes and AIDEN sees 200+ Integrations

This year, SOPHIA became the first tokenized editor agent with onchain logs. AIDEN grew into serving millions across Telegram and Discord, on track to be governed by its own token.

SOPHIA marked a turning point for how AI-generated knowledge can be audited and trusted. As the AI editor of IQ.wiki, every edit and wiki creation by Sophia is visible in its developer logs and recorded onchain, creating a verifiable public record of agent activity. This shift transformed SOPHIA from an interface into an accountable onchain actor, bridging AI-driven content creation with blockchain-native transparency. As the first agent to go live on the Agent Tokenization Platform, SOPHIA also introduced a new model for ownership and governance of digital labor through her native token, $SOPHIA. Alongside this technical milestone, SOPHIA also became more visible and accessible. She got her own homepage, giving the community a dedicated place to follow her work, editorial updates, and commentary across the IQ ecosystem. On IQ.wiki, new features like “Suggest Wiki” opened a direct conversational loop between the community and the agent itself, allowing users to propose new articles or improvements that SOPHIA then incorporates and publishes onchain.

At the same time, AIDEN evolved into the primary knowledge interface for IQ AI across Telegram and Discord, with integrations across more than 200 communities and millions of users reached. AIDEN’s growth throughout the year reinforced the role of conversational agents as front-end access points to onchain intelligence. With AIDEN on track to be governed by its own token, 2025 marked the moment when SOPHIA became a token-native agent, and AIDEN began its transition toward token-based governance.

What’s Next

As IQ moves into 2026, the momentum will continue. KRWQ will launch on new chains with additional liquidity pools. Look out for a new IQ-KRWQ pool in early 2026, creating additional protocol-owned liquidity and arbitrage opportunities with IQ’s significant KRW pairs on Upbit and Bithumb. KRWQ is also preparing partnerships with major institutions as it works towards its goal of becoming the Tether of Korea and leading the institutional offshore market for Korean won FX and NDF trading. IQ’s ecosystem continues to deepen on Base through new liquidity pathways and onchain integrations. Building on this foundation, IQ and the Agent Tokenization Platform are preparing to extend agent infrastructure to additional major blockchains. Looking ahead, IQ AI is expanding its focus on community-driven innovation, with more IQ AI hackathons planned to bring builders, researchers, and agents together. At the same time, KRWQ is laying the groundwork for decentralized IQ-KRWQ liquidity pools and positioning itself for institutional offshore adoption, with preparations underway to engage multiple institutions across Asia.

2026 is shaping up to be a pivotal year: work is underway at the intersection of AI, autonomous agents, and prediction markets, focused on enabling agent coordination and market-based decision making. Together, these steps mark a transition from early traction to sustained global scale - hold IQ and be part of what’s next.

To our builders, users, and IQ holders - thank you for backing and growing the IQ AI ecosystem this year. 2026 loads the next level.